An M&A Market Update for the Plastics Industry

by David Evatz

SRR

There continues to be strong demand for plastic companies across all end markets and manufacturing processes. Although acquisition demand is strong, there currently exists a general lack of quality deals in the marketplace, resulting in a supply/demand imbalance (i.e., more buyers than sellers). Global plastics M&A volume increased four percent during 2014, and despite a four percent drop during the first half of 2015, demand and overall activity are expected to remain strong.

Overview

A number of factors are driving strong M&A activity within the plastics industry. Strategic buyers, now sitting on record cash reserves, are looking to supplement organic growth with targeted acquisitions. Private equity firms, meanwhile, have roughly $350 billion in "dry powder," much of which was raised before the recession and will need to be committed soon or reach the end of its investable life. At the same time, debt and equity financing remains accessible and accommodating in terms of both pricing and availability. Finally, many of the more cyclical end markets within the plastics industry, such as automotive, heavy truck and housing, are at positive points in their respective cycles. This dynamic has driven strong M&A activity within these sectors.

Positive macroeconomic trends over the past couple of years also have had a positive impact on the plastics industry. Consumer confidence is returning to pre-recession levels, unemployment has eased to roughly 5.5 percent and US GDP continues to remain strong. The impact of these is apparent in the monthly Purchasing Managers' Indices (PMI), which indicate an expansion of the manufacturing sector if greater than 50. In 68 of the past 69 months, beginning September 2009, the sector has expanded. The domestic plastics industry, across end markets and manufacturing processes, also has become more competitive relative to certain low-cost country alternatives, particularly when factoring in quality, production flexibility and customer service. In addition, certain resin prices have declined over the past year, which has benefited processors.

Plastics industry M&A activity

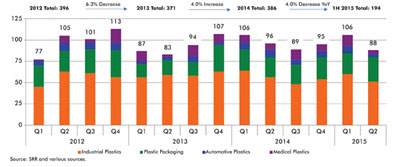

Activity currently is strong across all end markets, including traditionally stable and growing segments such as medical and packaging, but also within cyclical markets such as automotive and housing given the current cycle points. During the first half of 2015, industrial plastics companies continued to account for the lion's share of transactions at 57 percent, followed by plastic packaging at 28 percent and medical and automotive plastics at nine percent and six percent, respectively (see Chart 1). Industrial companies include heavy truck, appliance, aerospace/defense and several housing-related segments, among others. Plastic packaging transaction activity has shown the strongest growth over the past 18 months, with a 23 percent increase in 2014 and 10 percent growth during the first half of 2015. While automotive plastics M&A activity declined 29 percent during the first half of 2015, there was a 76 percent increase during 2014. Finally, industrial transaction activity declined eight percent during the first half of 2015, while the coveted medical segment saw a six percent increase.

Injection molding and extrusion transactions continued to represent the majority of deals during the first half of 2015, with 43 percent and 29 percent shares, respectively. This largely is due to the highly fragmented nature of these segments, particularly injection molding. Resin/compounding, thermoforming and blow molding represented numerous transactions as well, with 11 percent, six percent and four percent, respectively. There also was activity in the tool and die, prototyping, machinery, rotational molding and distribution segments. Thermoforming, injection molding and extrusion activity increased during the first half of 2015, growing 22 percent, four percent and four percent, respectively. While not significant in absolute volume, most of the other plastic processes declined during the first half of 2015.

Transactions involving strategic buyers represented 59 percent of the activity during the first half of 2015, followed by financial and hybrid (private equity-owned strategic) buyers at 24 percent and 18 percent, respectively. While representing a smaller share of activity, hybrid and financial buyer activity grew 17 percent and five percent during the first half of 2015, while strategic buyer transactions declined 12 percent. On the sell side, privately-owned businesses, which represented 59 percent of the activity, increased four percent, while the sale of corporate and private equity-owned businesses decreased seven percent and 26 percent, respectively.

The majority of plastics deals continue to be either domestic (both parties based in the US) or international. Domestic and international deals represented 37 percent and 48 percent of activity during the first half of 2015, respectively, with cross-border deals (one party in the US and the other international) accounting for 15 percent of transactions. Relative to the first half of 2014, international transaction activity increased 18 percent, while domestic and cross-border transactions declined 20 percent and 12 percent, respectively.

Plastics industry public company metrics

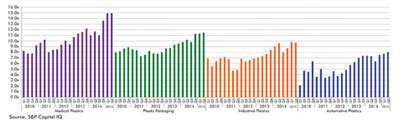

Whether medical, packaging, industrial or automotive, publicly-traded plastics companies continue to experience a high level of performance in both operating and market metrics. Most of these companies are trading at or near 52-week highs, with many trading near all-time highs, which has resulted in valuation multiples that are at, or higher, than pre-recession levels. That said, there has been a distinct difference among the end markets, with medical companies typically valued at the high end of the spectrum, followed by plastic packaging, industrial and automotive. In addition, trailing 12-month EBITDA margin averages for public companies edged slightly higher in the first half of 2015 (see Chart 2).

Conclusion

Based on economic indicators and recent trends, M&A activity in the plastics industry is expected to remain strong for the balance of 2015 and into 2016. Cash reserves of strategic buyers and "dry powder" of private equity firms, as well as encouraging capital markets, suggest strong demand for acquisitions. Abundant supply of natural gas and a shift in relative advantage of domestic resin producers also should positively influence activity. Finally, valuations for publicly-traded plastics companies are at or near recent highs, with private company transactions showing similar valuation trends.

Macroeconomic factors and industrial and consumer trends are all indicative of overall industry health. As they relate to company-specific health, however, the relative value of one processor versus another is driven by a multitude of factors, including company-specific performance measures. Ultimately, an individual company's valuation will be based on a number of value drivers, including end markets served, customer concentration, company size, profitability/margins, resin pass-through ability, book of business/future prospects, proprietary products or processes and overall amount of value-added content and niche market leadership.