Mobile Emissions and Fuel Economy Rev Up Lightweighting Initiatives

by Suzanne Cole

Miller Cole LLC

The world is shifting into high gear on fuel economy. The US and Canada became the first countries to set fuel economy standards toward 2025, and Mexico set its first standards. There were updated and extended light-duty fuel economy standards in the EU, China and Japan. In addition, standards were developed – though not yet implemented – in India, while discussions on standards are underway in some Southeast Asian and Latin American countries.

In August 2012, the federal government adopted the second of two rules dramatically increasing the fuel economy and decreasing greenhouse gas emissions from cars and light trucks. These two rules, in place for nearly five years as of the time of this writing, dramatically affect the production of vehicles in the US.

Fuel economy standards to see 90-percent increase over 15 years

The first rule, adopted in April 2010, raises the average fuel economy of new passenger vehicles to 34.1 miles per gallon (mpg) for model year 2016, a nearly 15 percent increase from 2011. The second rule, finalized in August 2012, will raise average fuel economy to up to 54.5 mpg for model year 2025, for a combined increase of more than 90 percent over 2011 levels. Fuel economy could reach 54.5 mpg if the automotive industry chooses to meet the greenhouse gas target only through fuel economy improvements.

The standards were adopted by the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA), with the cooperation of major automakers and the state of California. Together, the standards represent the largest step taken by the federal government directed at climate change. Passenger vehicles were responsible for 17 percent of US greenhouse gas emissions in 2011, and the August 2012 standards through 2025 will reduce the carbon intensity of these vehicles by 40 percent from 2012 to 2025.

The rule for model years 2017 to 2025 is projected to cut annual US oil imports by an additional six percent by 2025 from what would happen otherwise, or 400,000 barrels per day. When combined with the rule for model years 2012 to 2016, US oil imports are expected to decline by over 2 million barrels per day by 2025, equivalent to one-half of the oil the US imports from OPEC countries each day, according to EPA.

Most of the US transportation sector relies on oil as the single energy source, meaning any disruption can hurt the economy. A study by EPA and the Oak Ridge National Laboratory estimated that cutting demand for oil would produce an energy security benefit for the nationís economy of $13.91 (in 2011 dollars) for each barrel saved. In total, the rule for model years 2017 to 2025 is expected to save approximately 4 billion barrels of oil over the life of vehicles sold during this period.

EPA maintains that higher vehicle costs for fuel efficiency improvements will be far outweighed by fuel savings, with the average driver saving about $8,000 net over the lifetime of a model year 2025 car compared to a model year 2010 car.

Standards established for medium- and heavy-duty vehicles

Another rule adopted in August 2011 established the first-ever fuel economy and greenhouse gas standards for medium- and heavy-duty vehicles, which include tractor-trailers, large pickups and vans, delivery trucks and buses. These standards are projected to save a combined $50 billion in fuel costs, 530 million barrels of oil and 270 million metric tons of carbon emissions over the lifetime of vehicles for model years 2014 to 2018.

President Obama directed EPA and the Department of Transportation to propose new rules by March 2015, with final implementation a year later, for medium- and heavy-duty vehicles for model years after 2018. According to Miller Coleís analysis, new standards could improve the fuel economy of these vehicles by an additional 15 percent, reducing annual emissions by 50 million metric tons of CO2-equivalent in 2035. Transportation is second only to electricity generation as a source of US greenhouse gas emissions.

Implications for the plastics industry on a global basis What has become clear is that through the competitiveness of the plastics and automotive industries, the rewards for bringing game-changing innovation into the marketplace continue to be significant and will escalate as advanced plastic composites – namely, carbon fiber composites – become cost competitive.

Regulations are effectuating change in the plastics industry, but not many provide the opportunities for product and market growth for lightweight-enabling plastics the way that the 2012 Federal Fuel Economy regulations are driving the automotive industry.

Fuel economy and emissions reduction regulations are becoming more stringent world-wide, which represents a mega trend that also is excellent news for the plastics industry. Keeping in mind that the auto industry needs to achieve 54.5 mpg fleet average by 2025, this generally accepted industry statistic takes on significant relevance:

It is understood that automakers are willing to pay about $5/kg to reduce 1kg in their cars.

Now is the time for the plastics industry to step up to the plate with innovative materials, processes, efficient manufacturing and collaboration to capture the opportunity to maximize vehicle lightweighting opportunities, not only for US-produced vehicles, but for those manufactured across the globe.

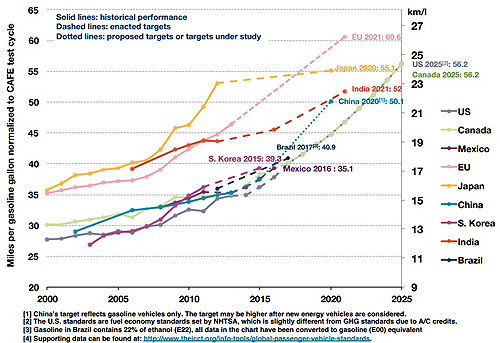

Chart 1 illustrates the global efficiency challenge. This means a serious "diet" plan is needed to include lightweighting and improved dynamic performance, as well as more efficient propulsion. Clearly, Europe and the rest of the world are seeking to emulate standards for fuel efficiency and emissions reduction. Adding to the urgency, China recently announced it will move from phase 3 to phase 4 fuel economy in 2015, which will represent a 36-percent fleet-wide improvement in fuel economy.

Manufacturing and material innovations speed improvements

As more automakers turn to new material choices to reduce the weight of their vehicles and to maximize fuel efficiency, innovations in plastics are driving the development of new vehicles that will spur further growth. Despite vocal dissention about its cost, OEMs are in active pursuit of carbon fiber reinforced plastics (CFRP). European automakers are leading the way, and some have introduced commercial vehicles with significant CFRP content, such as the BMW I-3 and I-7. Ford recently debuted a Ford GT carbon fiber-intensive sports car concept at the North American International Auto Show in Detroit in January.

With the continued support of the federal government through agencies like the Department of Energy (DOE), in concert with the American Chemistry Council (ACC), manufacturers will benefit from advancements to take cost out of manufacturing and processing CFRP – mainly elimination of labor in concert with energy-efficient manufacturing. Other roadblocks remain that have had manufacturers turning away from CFRP, including lack of predictive engineering tools/data, multi-materials joining, non-destructive testing for manufacturing, failure detection for repair, recycling and high-speed automated processing/manufacturing of CFRP components.

Today, two-thirds of the weight of high-volume vehicles is steel; 10 years from now, it is projected that plastics will comprise up to 65 percent of the weight of vehicles. CFRP is currently 5-10 times more expensive than steel, but five times stronger and weighing 50 percent less. With costs expected to decline by 70 percent over the next 10-15 years, CFRP is a real contender in the global automotive industry for light-duty vehicles, as well as for medium- and heavy-duty trucks.

More regulation discussions lie ahead

By law, NHTSA and EPA only can regulate fuel economy for five years at a time. A technology review will take place in early 2017 to determine whether technology exists to enable vehicle manufacturers to meet the mandated goals set forth in the fuel economy regulations for 2021-2025.

Automakers likely will appeal to EPA/NHTSA, along with the California Air Resources Board (which considers the 2025 regulations to be a "done deal" and has set its sights on 2050). Californiaís goal is to transition California (and the US) to a very low carbon economy, with a goal of 3.3 million zero-emission vehicles (ZEVs) on the road by 2025, which includes 1.5 million ZEVs on California roadways by 2025. ZEVs include hydrogen fuel cell electric vehicles (FCEVs) and plug-in electric vehicles (PEVs), which include both pure battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

So, how many ZEV credits does the entire industry need? According to Miller Cole LLCís analysis, the auto industry will need 900,000 ZEV credits by 2025. Given an average 100-mile range, 560,000 battery electric vehicles (BEVs) are needed. Given 150-mile range, 420,000 BEVs will be needed. ZEV III, which mandates the percentage of zero emission vehicles a manufacturer has to make available for sale in California, is proving to be a big task for many automakers!

Additionally, EPA has been driving to eliminate specific chemicals used in the production of plastics for vehicle interiors to prevent off-gassing of interior components. Many synthetic materials and plastics are produced with chemical additives that are used to change the engineering performance of the plastics; thus, these plastics may contain plasticizers, stabilizers, flame retardants, antimicrobials and antioxidants. Due to these additives, many pollutants – including benzene, toluene and xylene – were found in levels exceeding indoor and outdoor air quality standards. According to EPA, the concentrations of brominated flame retardants (BFRs) in vehicles contribute nearly 30 percent to total daily exposure.

Many automakers have been eliminating specific chemicals from vehicles and are requesting plastics that have renewable content (e.g. rice hulls), are green, sustainable and recyclable. Several vehicles today have eliminated flame retardants and PVC. Today, 17 percent of new vehicles have PVC-free interiors, and 60 percent are produced without BFRs in the interiors.

Consumers still in the driverís seat

In EPAís analysis of vehicle lightweighting potential for the 2012 rulemaking, EPA significantly underestimated potential improvements. Several models in production today, including light-duty trucks and passenger cars, have surpassed EPA lightweighting estimates. This is good news for the plastics industry overall as lightweighting is and will continue to be the enabler for OEMs to comply with strengthening global fuel economy and emissions regulations, enabling fuel economy without loss of functionality, engine downsizing, improved performance and handling, aerodynamics and systems integration.

As the automotive industry continues to expand globally in concert with increasing global regulations, the pace of technology innovation and cost reduction is increasing and ushering in a new era for plastics processors, whom have enjoyed a 10-15 percent increase in sales. If the growth of the middle class continues to increase in nations like India, China, Thailand (bigger than Russia) and Indonesia (bigger than Brazil), market demand will continue to increase for the entire plastics industry.

The true judges, however, are the end consumers. Innovation is key to the future of plastics and composites, but the ability to drive value to the end consumer by containing and reducing cost is what will make the entire industry globally competitive.