MAPP Survey Reports on 2015 Business Forecast

Plastics Business

Nearly 85 percent of plastics processing executives are expecting their 2015 sales trends to increase during the next 12 months, according to the most recent survey on the state of the US polymer industry from Manufacturers Association of Plastics Processors (MAPP). "Business conditions in the plastics industry have not changed from a year ago, as the overall industry remains strong and optimistic," stated Troy Nix, MAPP’s executive director.

MAPP, now in its 15th year of conducting its state of the industry report, collected data for its most recent report from 170 senior-level business professionals representing a vast range in company sizes and processing disciplines.

Fueling the optimism for a strong sales cycle during the next 12 months, plastics processing executives highlighted their expectations for what they anticipate to be the highest growth markets in 2015, led by the automotive industry. "The auto industry ended on a high note in December as the J.D. Power and LMC Automotive Report outlined continued sales growth for 2015," Nix said. "The new automotive light vehicle sales forecasts are flirting with numbers around the 16.9M to 17.0M unit level, and many senior analysts are optimistic that lower gas prices and a growing job market in 2015 will entice consumers to hit the show rooms, buy new homes and purchase consumable goods."

Along with these sentiments, business leaders responding to MAPP’s economic survey also highlighted the medical industry, consumer goods market and construction sector as areas that will provide support for their positive and aggressive sales forecasts.

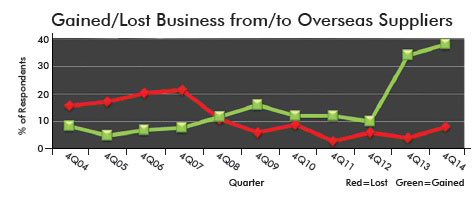

The data points compiled on the continuing fight to retain and regain business from overseas competitors were again the most dramatic of all findings in MAPP’s 2015 business forecast survey. Documented as the largest increase since MAPP began recording information on gains and losses of work to and from foreign businesses, 38 percent of this survey’s respondents indicated that they relocated work from overseas in 2014, which surpassed the data point of 34 percent reported a year ago. The survey also revealed that some American processors (eight percent in total) lost business to their overseas counterparts.

Plastics manufacturing business leaders like Mike Walter, the president of injection molder MET Plastics, use MAPP’s state of the industry report to provide a more realistic benchmark as to how he feels his own company stacks up to conditions in the general marketplace. "MAPP’s economic survey really is a compilation of ‘gut checks’ from the executives across the country who provide feedback," Walter said. "Although we aren’t necessarily benchmarking exact economic indexes, the trends identified over the last 15 years have been solid predictors of how our industry will perform."

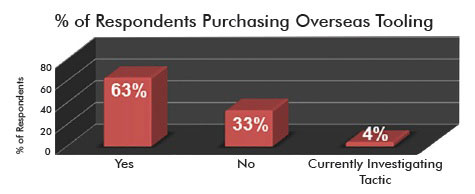

As US tooling manufacturers work to regain their foothold as the first source of supply, plastics processing executives continue to outsource molds to overseas locations. MAPP’s study revealed that 63 percent of survey respondents purchase molds from overseas suppliers, while four percent currently are examining this as a future tactic. This represents a six-percent increase from one year ago.

Although the overall outlook for growth and sales expansion is very optimistic for 2015, plastics manufacturing executives face a wide variety of external and internal challenges. Remaining as the top issue facing the vast majority of all business leaders is the lack of availability of a skilled and able-bodied workforce. The absence of technically inclined people, combined with the difficulty in finding individuals who simply want to work, continues to challenge business executives and has been identified as a significant constraint to growth. To combat this universal problem, many management teams are working to improve the culture of their workplaces by focusing on increasing employee engagement and overall morale. This strategy is being used to retain employees and attract top talent in the marketplace.

For the second consecutive year, sales revenue repeats as the second most pressing issue for American manufacturing executives. This finding has a bit of a twist. As many deal with the need for manufacturing diversity and the challenge in finding new revenue sources, managing and controlling rapid growth also has proven to be a noteworthy issue. About 45 percent of plastics processing leaders who identified "sales and growth" as an issue actually are more concerned with how they can handle the new opportunities they already have garnered. As a restatement from last year’s report, those caught in this uptick cycle are in need of increased production capacity, additional people, improved resource planning tools, more facility space and cash.

Rounding out the top three of the most pressing challenges is the issue of pricing pressures and controlling costs. Louder in this report is a cry for help for relief from increasing buildup of costs, including health care rates and rising labor expenses, along with the essential need to invest dollars in business improvements. As a slight offset to the costs that are increasing, MAPP’s study did again reveal a more stabilized raw material marketplace, which hopefully will continue well into the year.

MAPP’s full business forecast report contains information on 4th quarter performance and 2015 forecast data on employment levels, sales trends, procurement of production tooling, profitability trends and more. To obtain a copy of this report, visit the publications tab at www.mappinc.com.