Study Reveals Favorable Trends Impacting North American Processors

by Ted Morgan

Plante Moran

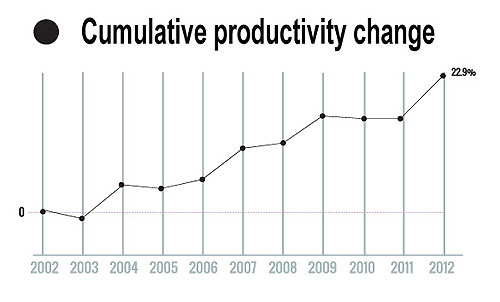

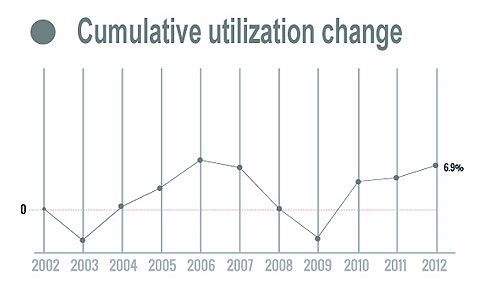

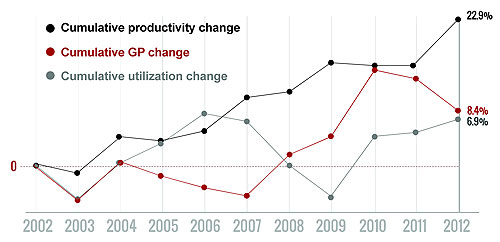

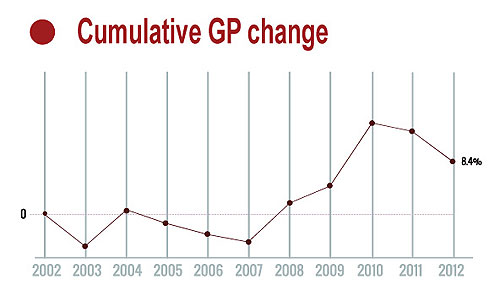

Graph 1: Year-over-year adjustments to productivity as measured by value-add per employee, equipment utilization percentage and gross profit margins for the last 10 years.

Graph 3: Resin pricing during the past 12-18 months has had only modest increases when compared to recent years.

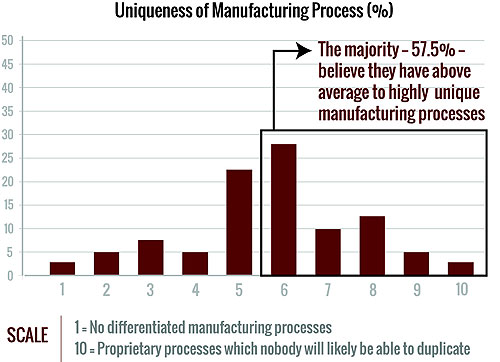

Graph 5: This highlights Plante Moran's findings on uniqueness of manufacturing process from the latest study.

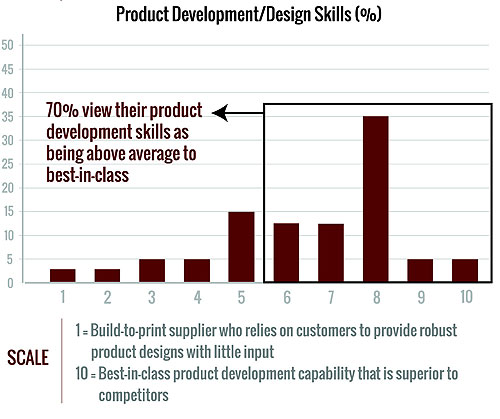

Graph 6: This highlights Plante Moran's findings on product development/design skills from the latest study.

About the NAPIS

- Participating in the North American Plastics Industry Study and the benchmarking that ensues allows processors to be brutally honest about their competitive differentiation. There is no charge for participating in the study. In return for participating, processors receive an 80+ page detailed report which communicates the results of the study and offers Plante Moran's related commentary on many of the results. The report is "board presentation" ready and is divided into a few key sections to provide industry and benchmarking analytics and a report card that grades the participating company against its peers.

- For more information about the Plante Moran survey and to download a complimentary copy of the 2013 Survey Report, which includes additional perspectives on the industry, please visit www.plantemoran.com.

How time flies. It wasn't too long ago that the plastics industry in North America was reeling. Plante Moran estimates that the Great Recession led to the failure of 1,000 injection molders alone. With the resurgence of manufacturing in North America in the past few years, the plastics industry has recovered quite well, as validated by the latest collection of data from the North American Plastics Industry Study (NAPIS). These conditions are creating opportunities for companies to expand into new geographic markets and technologies. But, can processors stay ahead of their thriving competitors? Do they have truly unique manufacturing skills? And, if the sale of the company is being considered, how ready is it for the beauty contest to attract top dollar?

Before this article sheds light on these questions, let's take a look at where the industry stands today by looking at some of the factors driving favorable company performance. As a frame of reference, since 1995, Plante Moran has led the NAPIS, which serves to gather and analyze the most empirical data collected in the plastics processing industry in North America. This year, 84 companies representing 131 facilities and $3 billion in sales responded to the survey. The majority of respondents were US-based, with some representation from Canada and Mexico.

The year-over-year adjustments to productivity as measured by value-add per employee, equipment utilization percentage and gross profit margins for the last 10 years (See Graph 1).

Press utilization and workforce productivity are at or near 10-year highs. Profits also are at historically high levels (although Plante Moran has seen a drop in the past two years, which we attribute to a sharp increase in product launches). In addition, the number of "successful companies" has doubled. The term "successful company," for purposes of this study, refers to any company that exceeds a 10 percent return on sales (before interest and taxes – adjusted for owner compensation), return on assets in excess of 15 percent and sales growth greater than five percent. In most years, fewer than eight percent of the survey respondents meet this criteria; however, this year, 16 percent of the respondents met this criteria. While the majority of the industry appears to be performing favorably as compared to recent years, this does not mean that all companies are thriving as roughly 25 percent of the study population lost ground with respect to EBITDA. For those companies experiencing favorable company performance, Plante Moran offers commentary on key drivers supporting their recent success.

Higher productivity

Labor productivity, as measured by value-add (sales less material and outside processing) divided by total full-time equivalents, significantly jumped in 2012 (See Graph 2). As we all learned, during the depth of the recession, companies were forced to figure out how to do more with less. It appears that many processors have retained this skill set post-recession. The industry as a whole also is getting into a rhythm operationally with the continued sales growth.

Higher profits

The two largest cost drivers for plastics processors are resin and labor. Control these two items and profits are almost certain to come. Resin pricing during the past 12-18 months has had only modest increases when compared to recent years (See Graph 3). In addition, a higher percentage of plastics processors are able to pass resin cost increases to customers. Regarding labor, as suggested above, the productivity data suggests that plastics processors continue to do more with less people (and subsequently, have been able to manage their labor costs).

Higher utilization

Press utilization increased for the third straight year (See Graph 4). The top quartile is in excess of 50 percent utilization for all presses, based on a 24/7 basis. While press utilization does not correlate with profitability, as many weak companies routinely lowball quotes to keep the presses running, the reduction of available capacity has brought pricing discipline to the industry. Interestingly, it appears the growth is strategic with a modest reduction in average complexity levels, meaning some low-volume customers were priced out of the company.

Other factors contributing to higher company performance includes sales growth and turnover:

Sales growth

Growth is required for enhancements to enterprise value. Profitability without growth is a slow death. Eventually, the skills that create the profits will commoditize and the business will lose its profitability, as well as growth. However, growth also is chaotic and exciting. Uncontrolled growth leads to bloated indirect staff that is only temporarily necessary, but often become permanent. Companies with controlled growth were normally the most profitable. However, in the current year, the typical company experienced growth in sales from seven percent to over 20 percent. Median sales growth was 11.5 percent. The growth appears to have allowed processors to be more discerning with customer contracts as median manufacturing complexity continues to decrease from 2010 (meaning less molds/resins in processors' production mix). While most processors in the industry welcome the rebound in sales, Plante Moran would expect current sales growth rates to be tempered in the medium- to long-term. This still is a cyclical industry, and we will see softness in demand once again.

Turnover

Personnel turnover is hovering at a very nice level of 22.8 percent, which is surprisingly low considering the demand for top talent. Part of the reason for the low turnover has to do with both increased wages and the greater use of automation. The ability to manage a complex environment is much easier (and productive) with a skilled and stable workforce. However, the continued slow recovery of the housing market is limiting employee mobility, which in turn limits the availability of skilled employees and also restricts employee turnover. Expect higher employee turnover when the value of homes recovers.

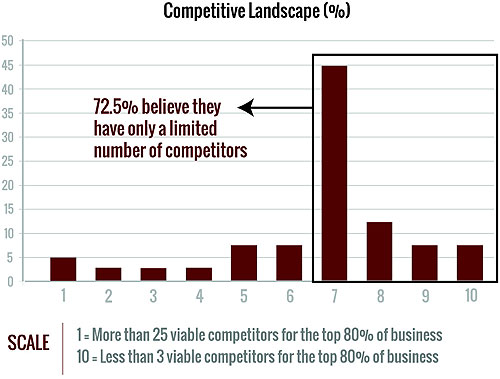

As an industry, we should be proud of our recovery. But, let's be honest. Processors think highly of themselves. When Plante Moran asks companies to rate themselves on the uniqueness of their manufacturing practices, product and design capability, and competitive position within the industry, the average is a six or seven on a 10 point scale. Theoretically, the average should be a five. However, the inflated value probably is due to ignorance of the competition and the market versus hubris of the respondent. Customers may have greater perspective of the differences between competitors than the companies involved do – a scary proposition. (See Graphs 5, 6 and 7)

A key takeaway from this year's study is for successful companies not to lose sight that they are one of many that are doing well. For struggling companies, it's critical to identify and address the organization's pitfalls – and quickly. The window of time is closing since much of the competition is thriving.

In conclusion, successful companies have a strong value proposition and often support their value proposition with quoting discipline. Companies that misfire often have high manufacturing complexity (number of presses, molds and resins to monitor and schedule) and misaligned organizational structures. An organization's enterprise value can be impacted today by taking a holistic approach to looking at the business, surrounding the business with talent that can keep up with today's pace of change and becoming an adaptive and innovative enterprise.