Cliff Notes and Other Tax Changes

by Michael J. Devereux II and Adam J. Herman, CPA/ABV/CFF, CVA, ASA, CFE

Mueller Prost PC

On January 2, 2013, President Obama signed the American Taxpayer Relief Act of 2012 (2012 Act), thereby retroactively averting the so-called "fiscal cliff." Absent any action by Congress, tax rates would have increased for all Americans and many of the tax provisions plastics processors rely upon to reduce their federal tax liabilities would have expired.

The following provides a brief summary of the tax changes made by the 2012 Act, along with an explanation of other tax changes taking effect in 2013 that affect plastics processors.

2012 Tax Rates Made Permanent for Most Taxpayers

Under the 2012 Act, the 10 percent, 15 percent, 25 percent, 28 percent, 33 percent and 35 percent individual tax rates are maintained into 2013 and made permanent. However, for taxpayers whose taxable income exceeds $450,000 (married filing jointly), $425,000 (heads of household) and $400,000 (single filers), the top marginal tax rate is reinstated to the increased rate of 39.6 percent.

This change preserves and makes the permanent the Bush1 tax cuts for over 98 percent of Americans.

Qualified Dividends and Long-Term Capital Gains

The maximum long-term capital gains and qualified dividend tax rates will remain at 0 percent/15 percent for those with less than the $450,000/$400,000 income thresholds. The 2012 Act reinstates the long-term capital gain and qualified dividend rate at 20 percent for high-income taxpayers (those with income greater than $400,000/$450,000 as noted above).

Further, by continuing to tie the qualified dividend rate to the long-term capital gain rate, the IC-DISC (Interest Charge – Domestic International Sales Corporation), remains a viable solution for privately held companies to permanently reduce its federal income taxes on exported products that were made in the United States.

Alternative Minimum Tax (AMT)

The 2012 Act permanently increased the AMT exemption amount and indexed it for inflation. By indexing the annual AMT exemption for inflation, Congress has removed the annual burden of "fixing" the AMT to ensure millions of additional taxpayers are not subject to it. The AMT was originally enacted to ensure that wealthy Americans pay a minimal amount of federal income tax. For 2012, the exemption amounts are $78,750 for joint filers and $50,600 for individual filers.

This increase to the AMT exemption, the higher marginal tax rates for individuals ($450,000/$400,000) and the continuation of bonus depreciation (AMT depreciation is equal to regular tax depreciation for bonus depreciable assets) will result in a wider gap between the taxpayer’s regular tax liability and the AMT, thereby allowing taxpayers to be able to utilize more general business credits, including the research tax credit.

Payroll Tax Holiday Allowed to Expire

The 2.0 percent payroll tax holiday for employees expired for wages paid after December 31, 2012. The 2010 Tax Relief Act temporarily reduced the employee’s portion of the OASDI (FICA) rate from 6.2 percent to 4.2 percent. The 2012 Act fails to extend this provision, thereby allowing payroll taxes to increase up to $2,274 per employee.

Research Tax Credits Extended and Modified

The 2012 Act retroactively reinstates the research credit for expenditures incurred in calendar years 2012 and 2013. Prior to the 2012 Act, the credit was only eligible for expenditures incurred prior to December 31, 2011.

Depending upon the methodology elected by the taxpayer, the credit is equal to 14 percent (alternative simplified credit method) or 20 percent (traditional credit method) of the research expenditures in excess of a base amount.

Eligible activities for plastics processors may include the following:

- Developing new part designs to meet customer specifications

- Developing new mold designs or improving upon transfer molds

- Experimenting with processing variables to develop new process (or improve existing processes)

- Improving processes through robotics or other types of automation techniques

- Experimenting with new resins

- Performing PPAP or first article inspections on new part designs

In addition to extending this popular tax incentive, Congress made two modifications to the credit. First, the 2012 Act clarifies the manner in which a taxpayer computes its qualified research expenditures in a tax year in which the taxpayer acquires a major portion separate unit of a trade or business that also incurred qualified research expenditures. Second, the 2012 Act changes the manner in which taxpayers, which are members of a controlled group of corporations or under common control, allocate the group’s credit.

Work Opportunity Tax Credit (WOTC) Extended

Retroactive to January 1, 2012 and through December 31, 2013, the 2012 Act reinstates the Work Opportunity Tax Credit (WOTC). The WOTC allows taxpayers to claim a federal income tax credit equal to 40 percent of the first $6,000 wages paid to a member of a targeted group of employees. Targeted groups include the following:

- Veterans in a family receiving supplemental nutrition assistance, unemployed veterans and service-related disabled veterans discharged from active duty

- Qualified ex-felons

- Families receiving benefits under the Temporary Assistance to Needy Families (TANF) program

- Designated community residents

- Vocational rehabilitation referrals

- Qualified food and nutrition recipients

- Qualified Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Qualified summer youth employees

Further, the WOTC is one of the few credits that may offset the AMT, making it particularly advantageous for taxpayers who are subject to the AMT.

Bonus Depreciation Extended for One Year

The 2012 Act extends the 50 percent bonus depreciation for assets placed in service prior to January 1, 2014, thereby extending the popular tax break for one calendar year. That is, taxpayers may claim an additional, "bonus" depreciation deduction equal to 50 percent of the basis of the new asset. The basis of the property and related depreciation deductions are adjusted accordingly for the year of purchase and later years in order to reflect the bonus depreciation allowance. As noted earlier, the additional depreciation deduction is available for both regular tax and AMT purposes.

Assets eligible for bonus depreciation generally fall with the following categories: property to which the modified accelerated cost recovery system (MACRS) rules apply with a depreciable life of 20 years or less; qualified leasehold improvement property and computer software that is not acquired in connection with the purchase of a trade or business. Further, the asset must be new, not used. That is, the original use commences with the taxpayer.

Enhanced Section 179 Expensing and Phase Out Limits Extended

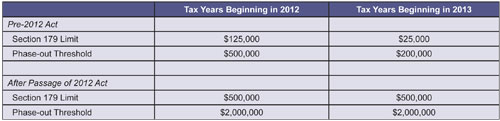

Section 179 allows taxpayers to elect to expense the cost of qualifying property up to a specific limit. The maximum expense amount is reduced by the amount of qualifying property placed in service in excess of a threshold amount. Prior to the 2012 Act, the Section 179 limit was scheduled to revert back to $125,000 with a phase-out threshold beginning at $500,000 for tax years beginning in 2012, and $25,000 with a phase-out threshold beginning at $200,000 for tax years beginning in 2013 and thereafter.

The 2012 Action increased the Section 179 limit to $500,000, with a phase-out threshold beginning at $2,000,000 for both tax years beginning in 2012 and 2013. The changes are illustrated by the table on page 34.

New Medicare Taxes

While passed in 2010, the Patient Protection and Affordable Care Act (Affordable Care Act) enacts specific tax increases beginning in tax year 2013. High-income taxpayers will be subject to two new taxes, beginning in 2013.

The 3.8 percent Medicare contribution tax will be assessed on the lesser of the taxpayer’s net investment income and a threshold amount. The threshold amount is $250,000 for those filing married filing jointly, $200,000 for single taxpayers and heads of households.

Net investment income includes interest, dividends, royalties, rental income, annuities and gains from the sale of property. Wages and income from a trade or business in which the owner materially participates are not included in net investment income.

However, net investment income includes closely-held businesses (such as S Corporations or Partnerships) in which the shareholder/partner/owner does not materially participate in the trade or business. Further, flow-through income from an entity owning rental real estate also may meet the definition of net investment income, depending upon the facts and circumstances of the specific taxpayer.

In short, the owners of privately-held, pass through companies may be subject to a new tax depending upon whether they materially participate in the operations of their trade or business.

In addition to the 3.8 percent Medicare contribution tax, the Affordable Care Act assesses a 0.9 percent additional Medicare tax on wages and self-employment of high-income taxpayers, in addition to the 1.45 percent that all wage earners pay. The 0.9 percent additional Medicare tax is assessed on the employee and applies to wages in excess of $250,000 for married taxpayers and $200,000 for single taxpayers and heads of households. Therefore, for a married employee, the total Medicare tax collected on his wages in excess of $250,000 sums to 3.8 percent (1.45 percent paid by the employer, plus 1.45 percent paid by the employee, plus 0.9 percent additional Medicare tax paid by the employee).

Changes to the Estate and Gift Tax

Effective January 1, 2013, the top estate/gift tax rate increases from 35 percent to 40 percent. The 2012 exemption of $5 million per person is extended permanently and applies to life-time gifts and the taxpayer’s estate. The exemption amount is indexed for inflation. In 2012, it was $5.12 million and is estimated to be $5.25 million in 2013.

Conclusion

Tax year 2013 has brought numerous changes to the tax law affecting those that operate in the plastics industry. Taxpayers who plan for such changes now and in the future can increase the profit and value of their company. Further, tax incentives such as the research tax credit, work opportunity tax credit and IC-DISC should be evaluated to ensure they are securing the benefits which Congress intended. n

1 The Bush tax cuts refer to those changes made by the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003, which temporarily decreased the tax rates on ordinary income, capital gains and qualified dividends.